"Amateurs want to be 'right.' Seasoned investors want to make money."I got a chuckle from article this evening about how technical analysis is useless. It was written by a fellow who admits in the opening lines that he does not use it and knows very little about it. Well, it is no real surprise then that he thinks it is useless.

It would be as if some child of nature from deep in the Amazon discovered an sextant left behind by some explorers, and found it to be very ineffective as an axe. Too short and bulky. Useless!

Or even more aptly, if an inexperienced but ardent weekend warrior were to receive a collection of tools as a gift and pronounce, after some cursory experimentation without experience and instruction, that a roofing square makes a very poor wood chisel indeed.

Seasoned traders tend to use whatever works for them in order to get the job done. They are focused on the task, and they improve over time by learning. And others like to argue, and debate seemingly without end on various chatboards. about systems and seers, about which is best for predicting the future, and the various merits of each. They do not want a set of tools, but a black box, or better yet, a crystal ball or a prophet. They focus on the means without fully understanding the place that they have in achieving the ends.

Don't do this. It is a complete waste of time. If there were even a nearly perfect system, or a prophetic voice who could tell you the course of future market prices even eight out of ten times, I guarantee you that they would not be dishing it out on the internet, at any price, unless they were as wise as Solomon and as selfless as angels.

There was intraday commentary about the unusually high volume of gold deliveries for the June contract on the Comex for the first three days of this period. Given the recent history, it is almost astonishing.

The European Central Bank did nothing today. It is what they seem to do best.

They suggested that they might start buying corporate bonds, presumably at non-market rates.

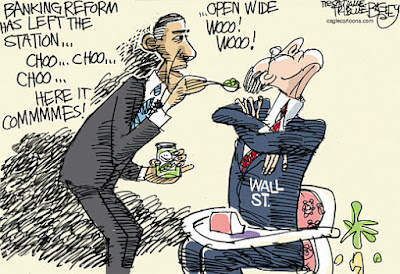

Why don't they just mail envelopes stuffed with cash to their corporate cronies and banksters? I mean, from what I can tell, most of the policy in the US and Europe has been focused on further enriching a wealthy few, and sustaining a corrupt financial system that is unsustainable without heavy subsidies and seigniorage of information, special allowances, and outright monetary assistance.

In the European Bank's defense, the Fed is just as bad or worse when it comes to lack of principles, class myopia, and cronyism.

I have a hunch that gold and silver are being capped here for a reason. Maybe. It's hard to tell with the non-linear Fed.

As old Sister Killian used to say of such behaviour, 'babies must play.'

Non-Fulltime Payrolls Report tomorrow.

Have a pleasant evening.