"When the political process becomes controlled by multi-national corporate interests, the US government becomes a tool of those interests. When multi-national corporations own the mass media as they presently do, honest democratic debate becomes unlikely.

As we witness corporate power becoming a dominate force in international relationships, it will surely continue to diminish independent national sovereignty under the banner of 'free trade.'"

Joseph A.

19 October 2014

'Confidence' Is a Corollary In a Fiat Culture: The Triumph of the Shills

12 March 2013

Gold Daily and Silver Weekly Charts - The US Dollar: Keeping Up Appearances

Ron Paul: "I had a Federal Reserve Board Chairman testify before the committee that the gold standard had some merits but it was unnecessary because central bankers have now learned how to manage a Fiat currency in a manner in which it would mimic the gold standard. Would anybody care to comment about where the flaw is in that thinking?"

Mr. Lehrman: "I am anxious to comment on that, Dr. Paul. Under--and I must say Mr. Greenspan made the same insipid remark. Mr. Greenspan and Mr. Bernanke will have to then explain why it was that two of the greatest booms in American history, and two of the greatest panics and busts in American financial history, occurred under their 25-year watch..."

Mr. Grant: "The failure of AIG is so instructive in this respect. AIG, this immense insurance company with this ever so brilliant financial products group, didn't do one thing. It didn't mark its positions to market. Finally came the day of judgment and it argued with Goldman Sachs about what these things were worth, AIG said 100 cents on the dollar, Goldman Sachs said not close, Goldman Sachs won that debate and AIG failed.

As with AIG and Goldman Sachs, so it is today with the United States and its Asian trading partners. We never clear our trades. Our dollars go there, and they come right back here. We run twenty five consecutive years of debts on a current account and there will be for us, as there was for AIG, a moment in truth in which we must settle."

U.S. House of Representatives, Committee on Financial Services, Testimony of March 17, 2011

The US will settle, in paper dollars. And if the payment is insufficient, they can always create more.

That is the long and short of it, and the sophistry of modern money. Because the value of the money is self-referential, it is in essence a literal confidence game. The dollar is worth what we say it is, and it is worth it because we say it, without regard to other opinions and considerations to the contrary. And as long as people believe this, or even pretend to believe this even if they don't but are afraid of the consequences of their disbelief, the dollar hegemony is secure.

Money is a matter of force and confidence; and when confidence wavers, force must provide. Force can take many forms, from persuasion to deception and even compulsion.

So the appearance of solidity and confidence must be maintained no matter what. It must, as apparently Messrs. Greenspan and Bernanke have said, must 'mimic the gold standard.' And they are right. Caesar's wife must be above reproach, and the fiat dollar is the dowager queen of empire.

That is why the chat board gimmickry of the platinum coin was such a remarkably dangerous folly. Even given that money is a somewhat specialized area of study, it was shocking that a distinguished economist like Paul Krugman did not seem to understand it. I could attribute that to a moment of political weakness.

But the rest of the world did understand exactly what was happening, and held its breath. Would the US dare to cynically impugn the basis of its debt, even by implication?

Perhaps the greater question, such silliness as trillion dollar platinum coins aside, is how far the Anglo-American financial system is willing to go to keep up the appearance and dignity of a stable global reserve currency in the dollar, even while the dollar is being used and abused by the financiers like a 12th Avenue hooker?

I think you know that I believe that the paper metals markets are an accident waiting to happen, particularly with regard to silver.

It appears that the exchange and the regulators are managing the markets with reckless disregard for their soundness.

So let's see what happens.

14 March 2012

Smith: Why I am Leaving Goldman Sachs

"And remember, where you have a concentration of power in a few hands, all too frequently men with the mentality of gangsters get control."

John Dalberg Lord Acton

This is an interesting commentary not only on Goldman but on the entire Anglo-American banking cartel as well. An executive at the 'bank' has resigned in moral revulsion.

But Wall Street need not fear those who refuse, in acts of conscience, to participate in the looting of customers and the abuse of the public trust. There are always others more than willing and eager to take their place. Siewert, Former Geithner Aide, Heading To Goldman.

The reaction from Wall Street is that Mr. Smith, a ten year veteran, sounds naive. Dick Bove just told one of the giggling spokesmodels that if Goldman rips off its customers, and the suckers keep coming back for more, then that is the stock to buy. They are just that good.

Let's not get too misty or wax romantic about this. Goldman Sachs was a major corrupting force that contributed to the collapse and Depression of the 1930s, earning their own chapter in John Kenneth Galbraith's The Great Crash of 1929, In Goldman Sachs We Trust.

Greg Smith's comments on leadership are spot on. The tone of an organization is heavily influenced, if not set, by the behaviour and the policies of the leadership. And the part that character and honesty play in this has somehow been forgotten, abandoned.

"A genuine leader is not a searcher for consensus but a molder of consensus."

Martin Luther King

I can advise Mr. Smith that if he is disgusted at the behaviour on Wall Street, he ought never to go to Washington, which is replete with those who would do anything for power.

When it comes to 'ripping off their clients,' the politicians of the past twenty years are the real professionals. Not only thieves, but rapists and torturers and conmen.

And this is why the relationship between the corporate sociopaths and the government, known colloquially as crony capitalism, is such an historically recurrent theme. Heart speaks to heart.

This Republican primary is one of the most disgusting spectacles of pandering and deceitful cynicism that I can remember. And the Democrats and their faux reformers are little better. MF Global and the lack of investigations and prosecutions in times of general financial fraud prove that.

Corruption is the coin of the realm. And the nation suffers.

"The preposterous claim that deviations from market efficiency were not only irrelevant to the recent crisis but could never be relevant is the product of an environment in which deduction has driven out induction and ideology has taken over from observation.

The belief that models are not just useful tools but also are capable of yielding comprehensive and universal descriptions of the world has blinded its proponents to realities that have been staring them in the face. That blindness was an element in our present crisis, and conditions our still ineffectual responses.

Economists – in government agencies as well as universities – were obsessively playing Grand Theft Auto while the world around them was falling apart."

John Kay, An Essay on the State of Economics

And that is why there will be no sustainable recovery, but instead, the whirlwind.

NYT

Why I Am Leaving Goldman Sachs

By GREG SMITH March 14, 2012

TODAY is my last day at Goldman Sachs. After almost 12 years at the firm — first as a summer intern while at Stanford, then in New York for 10 years, and now in London — I believe I have worked here long enough to understand the trajectory of its culture, its people and its identity. And I can honestly say that the environment now is as toxic and destructive as I have ever seen it.

To put the problem in the simplest terms, the interests of the client continue to be sidelined in the way the firm operates and thinks about making money. Goldman Sachs is one of the world’s largest and most important investment banks and it is too integral to global finance to continue to act this way. The firm has veered so far from the place I joined right out of college that I can no longer in good conscience say that I identify with what it stands for...

It makes me ill how callously people talk about ripping their clients off. Over the last 12 months I have seen five different managing directors refer to their own clients as “muppets,” sometimes over internal e-mail...

Read the rest here.

30 October 2009

Nine More Banks Fail with CIT a Packaged Bankruptcy While Gold Shines in a Jobless Recovery

There was tension-driven selling in the markets today despite the 'good news' in the headline economic numbers. The markets are on edge ahead of the ADP and BLS jobs numbers next week. The much touted theory of a 'jobless recovery' is started to show some big holes in credibility, as well it should.

Jobless Recovery

A jobless recovery is nothing more than a euphemism for a monetary asset bubble presenting an ongoing systemic moral hazard.

Yes, jobs growth lags GDP in the early stages, everyone knows this. A second year econ student might cite Okun's Law, although it is better called Okun's observation, to show that lag, but it is not relevant to this topic. Beyond early stage lags in the typical postwar recession, a business cycle contraction, what is meant by the jobless recovery is the post tech bubble recovery of 2001-5 wherein jobs growth lagged economic growth in a way we have not seen after any postwar recession, with the median wage never recovering. "Jobless recovery" is a relatively recent phenomenon in the economic lexicon, much younger than 'stagflation' which was thought highly unlikely if not impossible by economists based on their theories, until it happened.

It was the housing bubble and an explosion in unproductive financial activity crafted by the Fed and the Wall Street banks that provided the appearance of economic vitality in 2001-7. It was no genuine recovery despite the nominal GDP growth. It indicates a need to deflate the growth numbers more intelligently, if not more honestly, and future economists are likely to 'discover' this, although John Williams of Shadowstats has done a good job of demonstrating the distortions that have crept into US economic statistics. The tech bubble was perhaps an unfortunate response to the Asian currency crisis and fears of Y2K. What was done to promote recovery from the tech collapse and create the housing and derivatives credit bubble was pre-meditated and criminal.

The current state of economics is most remarkable for its arrogant complacency in the face of two failed bubbles, a near systemic failure, a pseudo-scientific perversion of mathematics exposed, and an incredible capacity for spin and self-delusion. The people wish to believe, and Wall Street and the government economists are all too willing to tell them whatever they wish to hear, for a variety of motives. And there is an army of salesmen and lobbyists and econo-whores touting this fraud around the clock.

The Failure of Financial Engineering

The next bubble should provide the coup de grâce when it fails, although the fraudsters might try and spin ten years of a stagflationary economy as 'the new normal.'

There are good reasons for this failure of American "monetary capitalism," and it has to do with an oversized financial sector and a surplus of white collar crime that both distort and drain the productive economy. The current approach is to pump money into a failed system without attempting to reform it, to fix its fundamental flaws, to make an honest accounting of the results. The result are serial bubbles and the foundation for long duration zombie economy with a grinding stagflation that may morph into a currency crisis and the fall and reissuance of the dollar, as we saw with the Russian rouble. It will stretch the political fabric of the US to the breaking point. This is how oligarchies and their empires fall.

CIT Staggers Into Bankruptcy

Trader confidence was shaken by more indications that business lender CIT will declare a preplanned bankruptcy next week.

Approaching Crash in Commercial Real Estate

Also roiling the markets was a shocking warning by billionaire Wilbur Ross of an approaching meltdown in the Commercial Real Estate market which has been anticipated and warned about by non-shill market analysts.

Gold Holds Steady

Gold showed a remarkable resilience today against determined short selling in the paper Comex markets. Here is a decent summary of the case that the gold bulls have been making, in addition to the standard observations about dollar weakness. Gold Bullion Market Reaching the Breaking Point

Bank Failures Hit 115

Meanwhile, nine more commercial banks rolled over this week. Calculated Risk reports that the unofficial FDIC list of problem US banks now numbers 500.

Here is the list from FDIC of all Official US Bank Failures since 2000.

All of the nine banks were taken over by the US Bank National Association (US Bancorp), and were part of the FBOP company in Oak Park, Illinois, one of the largest privately held bank holding companies in the US. It is reported that all nine were heavily invested in real estate lending.

California National is the fourth largest bank failure this year. It lost about $500 million on heavy investments in Fannie Mae and Freddie Mac preferred shares, in addition to overwhelming losses in California real estate.

North Houston Bank, Houston, TX, with approximately $326.2 million in assets and approximately $308.0 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Madisonville State Bank, Madisonville, TX, with approximately $256.7 million in assets and approximately $225.2 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Citizens National Bank, Teague, TX, with approximately $118.2 million in assets and approximately $97.7 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Park National Bank, Chicago, IL, with approximately $4.7 billion in assets and approximately $3.7 billion in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Pacific National Bank, San Francisco, CA, with approximately $2.3 billion in assets and approximately $1.8 billion in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

California National Bank, Los Angeles, CA, with approximately $7.8 billion in assets and approximately $6.2 billion in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

San Diego National Bank, San Diego, CA, with approximately $3.6 billion in assets and approximately $2.9 billion in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Community Bank of Lemont, Lemont, IL, with approximately $81.8 million in assets and approximately $81.2 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Bank USA, National Association, Phoenix, AZ, with approximately $212.8 million in assets and approximately $117.1 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

20 January 2009

How's Your Confidence In US Business?

Not very strong, apparently, if you are a CEO of a US business, as measured by the folks at the Conference Board.

Perhaps they should survey the Chief Market Strategists appearing on the extended infomercials that pass for financial news reporting in the States instead.

State Street Bank: Hammered

Today is an especially interesting day.

Today is an especially interesting day.

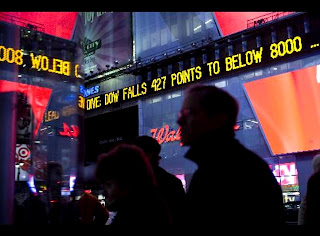

US equities, led by the financials, are getting absolutely hammered, the longer Treasury bonds are down, dollar and gold and oil are up. The dollar strength may be more of a sign of euro weakness.

Royal Bank of Scotland and State Street Bank seem to have shaken up the confidence of the Asian and Mideast investors, and pehaps the continental Europeans.

We'll know more as the week progresses.

Bloomberg

State Street Falls Most Since 1984 on Bond Losses

By Christopher Condon

Jan. 20 (Bloomberg) -- State Street Corp., the world’s largest money manager for institutions, fell the most since 1984 in New York trading after unrealized bond losses almost doubled and analysts said the company may have to raise capital. Unrealized losses on State Street’s fixed-income investments rose to $6.3 billion at Dec. 31 from $3.3 billion at Sept. 30, the result of falling values throughout the credit markets, the company said today in a statement. State Street also incurred $528 million in costs to prop up money funds and write down the value of investments on its portfolio...

Unrealized losses on State Street’s fixed-income investments rose to $6.3 billion at Dec. 31 from $3.3 billion at Sept. 30, the result of falling values throughout the credit markets, the company said today in a statement. State Street also incurred $528 million in costs to prop up money funds and write down the value of investments on its portfolio...

Unrealized losses on assets held in conduits increased to $3.6 billion from $2.2 billion. The filing also revealed that the company had purchased $2.5 billion securities from the stable-asset funds...

State Street said that the net asset value of another group of unregistered funds had fallen as low as 91 cents a share on Dec. 31. These funds, which invest cash collateral that State Street customers receive in return for lending out their securities, also seek to maintain a net asset value of $1 a share, though they are not required to do so. The average value of these funds at Dec. 31 was 95.5 cents a share, State Street said in the filing, with a substantial portion of the decline occurring during the fourth quarter. Total assets in the affected funds have fallen to $113 billion on Dec. 31, from $178 billion a year earlier.

The average value of these funds at Dec. 31 was 95.5 cents a share, State Street said in the filing, with a substantial portion of the decline occurring during the fourth quarter. Total assets in the affected funds have fallen to $113 billion on Dec. 31, from $178 billion a year earlier.

State Street has continued to sell and redeem shares of these funds at $1 a share, it said in the filing. The funds can wait until the securities mature and they receive full face value from the borrower, rather than selling the holdings in the market at a loss.

The Jan. 16 filing said that continuing to sell and redeem shares at $1 may prevent State Street from passing on the losses later to shareholders if the value of the securities in the fund don’t recover.

The company also set aside $200 million to cover losses stemming from indemnification obligations on $1 billion in repurchase agreements that State Street clients purchased from Lehman Brothers Holdings Inc. The investment bank filed for bankruptcy protection Sept. 15.