24 November 2014

21 November 2014

China SGE Gold Withdrawals For Week 52 Tonnes

The Shanghai Gold Exchange withdrawals were 52.26 tonnes for the week ending 14 November.

To put this into perspective, there are a total of 27 tonnes of gold bullion in the registered 'deliverable' at these prices category in all the Comex warehouses now.

That's only a few days supply work in Shanghai.

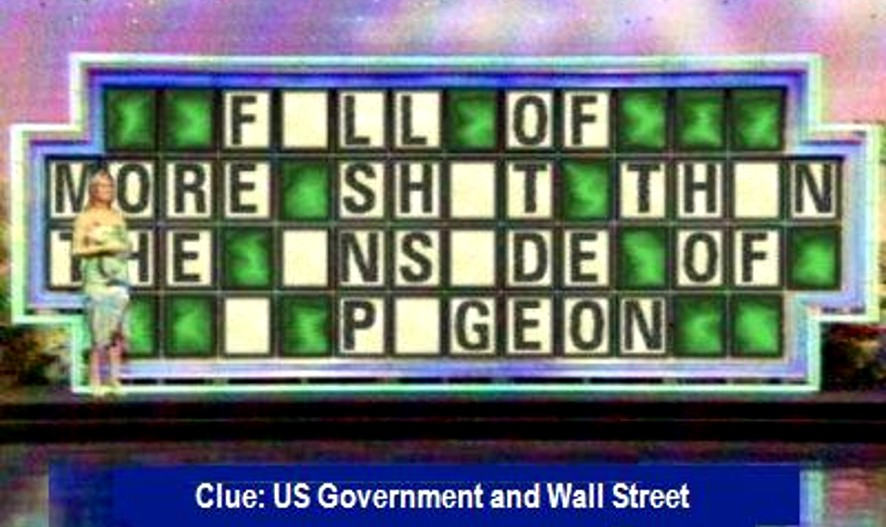

The point of this, of course, is that as a price discovery mechanism the Comex hardly merits the title anymore relative to the new physical markets in Asia since so little bullion is actually changing hands and being withdrawn, and their leverage is so high.

Compared to China it is like a game of Liar's poker. And how apt that comparison might be.

Category:

Shanghai Gold Exchange

Gold Daily and Silver Weekly Charts - Comex Option Expiration Monday

Monday will be the last Comex option expiration for the year, for the December contract. We may wish to brace for shenanigans. We are reaching a more critical point in the markets, but do not, absolutely do not, expect this to be easy.

The big changes come when we least expect them, and then as a thief in the night. Betting on short timeframes with leveraged bets is a losing trade 99 times out of 100. And if you hit it big one time, you may chase that adrenalin high again and again, until you are exhausted by the time things really break your way.

Gold and silver continue to dribble out of the Comex warehouses. For a quiet month we saw a bit of gold taken out of New York.

There was some very interesting news today. I featured both items.

As it turns out while Germany was waiting and the Swiss are considering their decision, the Dutch managed to quietly, some say secretly, repatriate a good chunk of their gold from New York back to Amsterdam. From their glory days roaming the world the Dutch understand that possession is nine-tenths of the law.

We also heard Senator Carl Levin criticize the Federal Reserve for enabling the Banks obtrusive entry into the commodity markets, where they were faced with a candy store of opportunities to manipulate prices, obtain inside information, and to basically fill their own greedy pockets by using subsidized funds from the Fed.

Levin may as well have turned to his colleagues on the Hill and shamed them as well.

Until there is reform, there will be no recovery.

Nobody wins unless everybody wins.

Have a pleasant weekend.

SP 500 and NDX Futures Daily Charts - Another Record Close, Sweet Dreams Baby

We will see the second estimate of Q3 GDP on Tuesday.

The market is hitting a bit of a high note here, with record close after record close.

The market is going to break. I don't know how deep it might be because I cannot yet tell if this will be a normal wash and rinse or the beginning of something more involved. It probably depends on what provokes it.

Let's be thankful for what we have. And remember what is most important in life. Things can be replaced, but people can't.

Have a pleasant weekend.

Senator Levin: Fed Enabled Banks To Elbow Way Into Commodities, Manipulate Prices

Apparently Senator Levin is not expecting many $250,000 speaking engagements from Wall Street after he leaves the Senate.

The Wall Street Banks have NO business using their subsidized banking funds and deposits to speculate in global markets for their own accounts.

This was the basic safeguard provided by Glass-Steagall for almost sixty years that was overturned in a bipartisan political effort at gettin' paid.

US Senator Carl Levin Opening Statement, Day Two

"The Federal Reserve is considering arguments that Wall Street banks provide hard-to-replace services in these areas. But the separation between banking and commerce has served markets and our economy quite well for decades. And the erosion of that barrier is clearly doing harm today.

Any discussion of these physical commodities activities must begin and end with the need to protect our economy from risk, our markets from abuse and our consumers from the effects of both.

Wall Street banks with near-zero borrowing costs, thanks to easy access to Fed-provided capital, have used that advantage to elbow their way into commodities markets.

Bad enough that this competitive advantage hurts traditional commercial businesses; worse that it opens the door to price and market manipulation and abusive trading based on nonpublic information."

Read the entire statement here.

Plutarch, De Superstitiones 171

... but with full knowledge and understanding they themselves offered up their own children, and those who had no children would buy little ones from poor people and cut their throats as if they were so many lambs or young birds; meanwhile the mother stood by without a tear or moan; but should she utter a single moan or let fall a single tear, she had to forfeit the money, and her child was sacrificed nevertheless; and the whole area before the statue was filled with a loud noise of flutes and drums took the cries of wailing should not reach the ears of the people.

Category:

commodity prices,

price manipulation

Subscribe to:

Posts (Atom)